3SPOKE is a private investment firm providing structured liquidity solutions to owners of late-stage venture assets.

[ ABOUT ]

Investing in the Next Generation of Innovation

3SPOKE invests in the next generation of visionary and disruptive global companies. These innovative companies continue to mature and grow larger and more valuable while remaining privately held, creating enormous pent-up demand for liquidity from their stakeholders. 3SPOKE addresses this need by providing structured liquidity solutions for this dynamic ecosystem.

Providing shareholders, venture funds and their investors with highly flexible capital, allowing them to continue to participate in future growth without locking in current market discounts, taxes or a change in control.

We offer investors risk-mitigated access to the most successful private companies, while taking growth rather than concept risk.

[ TEAM ]

Pioneers in Structured Liquidity Solutions

3SPOKE is led by an experienced team of professionals and are early pioneers and innovators in the use of structured liquidity solutions for the venture capital ecosystem. Operating with integrity, transparency and trust, our team builds long term partnerships with shareholders, management teams and venture investors.

STEVE GOLD

CO-FOUNDER & MANAGING PARTNER

Experienced investment professional with over 25 years of experience advising entrepreneurs and investing in technology-enabled companies. A seasoned venture fund manager and secondary venture investor, with the last 10 years focused on pioneering and innovating the structured financing market for stakeholders of venture capital-sponsored assets, utilizing private shares or partnership interests as collateral.

CURRENT

Steve is the Co-Founder and Managing Partner of 3SPOKE and is responsible for all aspects of the management and strategic direction of 3SPOKE. As an early pioneer of structured venture lending, Steve created a new way to provide liquidity to stakeholders of leading venture backed private companies (including individual executives & shareholders, General Partners, and Limited Partners) prior to an IPO or sale.

Steve directs the firm’s investment process and chairs the 3SPOKE Investment Committee.

PRIOR

Steve was a Founding Partner of VSL Partners; Co-manager VSL Partners, LP and VSL Partners II, LP. As a Co-founder, Steve conceptualized the firm’s investment strategy and was instrumental in the development of the firm’s unique transaction structure. Steve led deal sourcing and execution for a significant percentage of the firm’s portfolio investments and co-investments across the firm’s two investment funds and was a member of the VSL Investment Committee.

Managing Director, Citi Private Bank: Steve joined Citi following the spin-off of Smith Barney to a JV with Morgan Stanley to aid in the strategic development of a global, fee-only investment advisory offering for clients of the Private Bank.

Director, Harris myCFO Investment Advisory Services: Steve led the investment team in the U.S. Western Region for a national multi-family investment office. Steve directly managed many of the firm’s largest and most sophisticated family relationships, representing over $4.5 Billion in assets directly under advisement, with combined overall net worth exceeding $40 Billion. Steve was a member of the firm’s Asset Allocation, Alternative Investment and Executive Committee’s.

INTERESTS

Steve is a gourmet home chef and a sports enthusiast, with a particular interest in golf, tennis, cycling and skiing. Steve lives in Boulder, Colorado with his wife and two young daughters.

EDUCATION

Chartered Financial Analyst (CFA), CFA Institute

BBA, International Finance, The George Washington University

IAN LEISEGANG

CO-FOUNDER & MANAGING PARTNER

Experienced private secondary market asset manager, technology entrepreneur, structured and derivative investments asset manager, financial assets, and financial markets professional with formal Chartered Accountant and Chartered Financial Analyst qualifications, combined with 25+ years experience.

CURRENT

Ian is the Co-Founder and Managing Partner of 3SPOKE and is responsible for all aspects of the management and strategic direction. Ian co-directs the firm’s investment process, leads the firm’s investor relationships, finance & operations and co-directs the 3SPOKE Investment Committee.

PRIOR

Ian has significant global public and private markets investment, trading and operating experience. Ian commenced his international investment banking and financial markets career on the derivative trading desks of the leading global financial firms in London, England. Followed by Ian co-leading the retail derivatives business and co-covering the institutional equity derivative client base for Deutsche Bank, South Africa. Prior to co-founding 3SPOKE, Ian co-led JPMorgan’s TMT industry coverage group out of the private bank, where he provided investment advice to the wealthiest private clients and family offices.

INTERESTS

Ian is a sport enthusiast, playing competitive golf with additional interests in yacht racing and mountain biking. Ian believes in actively supporting his community and has historically chaired the board of Orange County, United Way and been an active board member of UCI’s Applied Innovation Center. Ian lives in Orange County, California with his wife of 20+ years and their three children.

EDUCATION

CFA, CFA Institute

CA(SA), South African Institute of Chartered Accountants

B.Com (Honors), University of South Africa

B.Com (Accounting), University of the Witwatersrand

MATTHEW HARMAN

PRINCIPAL

Experienced investment professional with over 25 years of investing experience managing portfolios across public and private equity and credit securities in hedge fund, PE, and venture strategies. Deployed nearly $1 Billion in investment capital across primary & secondary direct, derivative, and structured investments in technology-driven growth assets since 2018.

CURRENT

Matthew is a Principal of 3SPOKE and is a member of the firm’s senior leadership and investment teams. Matthew is involved with sourcing, structuring, and underwriting portfolio investments as well as capital-raising activities.

Matthew is a member of the 3SPOKE Investment Committee.

PRIOR

Before joining 3SPOKE, Matthew was a Principal at Conversant Capital, and Head of Conversant Secondary Partners, focused on exploiting a structured secondary opportunity providing liquidity to holders of private REITs.

As a Senior Managing Director, Co-Head of Venture investing, and Head of Trading at Serengeti Asset Management from 2012 through 2022, Matthew co-created and ran the firm’s core private investment strategy focused on structured liquidity solutions for shareholders and option holders of mid and late-stage private growth companies. This strategy became one of the largest of its kind with over $700 million invested creating a portfolio of exposure to nearly 130 different private growth unicorn companies over a period of four years. While at Serengeti Matthew was a board member of privately held portfolio company, AMC, a direct advertising arbitrage business.

Prior to Serengeti, Matthew was Head of Trading and Portfolio Manager for the global distressed debt and special situation equity Hedge Fund team at MatlinPatterson, an $8 Billion+ AUM distressed debt-focused investment manager.

INTERESTS

Matthew’s passion is investing and is an avid reader of historical biographies and an active basketball and tennis player. Matthew lives in Livingston, New Jersey with his wife of 20 years and their three daughters.

EDUCATION

B.A., History, Literature, Economics, Duke University

Former board member of the Freeman Center for Jewish Life at Duke University

CRAIG WHITE

MANAGING DIRECTOR

Experienced investment professional with 20+ years of alternative investment proficiency across private equity and private credit opportunities working with global institutional investors, deploying over $3BN in committed capital mandates through direct, co-investments and partnership investments.

CURRENT

Craig is primarily responsible for building out and managing the 3SPOKE institutional investor base and will be a member of the 3SPOKE Investment Committee.

PRIOR

Partner and Head of Alternative Credit, Stafford Capital Partners: A senior alternative investment professional managing private credit allocations at a $5B asset management firm. Craig conceptualized, organized and led a new product vertical focused on global alternative credit strategies and launched with a $300 million commitment from an Australian Superannuation fund. Craig chaired the investment committee.

Employees Retirement System of Texas: Portfolio Manager, Private Equity. Deployed over $1 billion across commitments, direct and co investments across a global portfolio of buyouts, distressed debt, growth equity and secondaries for a $30 Billion defined benefit public pension plan.

Drum Capital Management: Managing Director. Spun out a special situations and private credit fund from Pacific Corporate Group and grew the assets to over $900 million in committed capital.

Earlier in his career, Craig was Vice President and Investment Consultant of the Private Markets Group with Callan Associates.

INTERESTS

Craig is an outdoor enthusiast, with a particular interest in trail running and camping in the North Georgia Mountains. He lives in Atlanta with his wife and three children.

EDUCATION

B.A., Business & Managerial Economics, California State University

Master of Science, Finance, Golden Gate University

CHRIS HSUAN

DIRECTOR

Experienced investment professional with over 14 years of experience, with the last nine years focused on investing in private equity secondary transactions. Experience leading complex transactions across GP and LP-led secondary opportunities, with significant experience deploying capital through directs, partnership investments, and co-investments.

CURRENT

Chris Hsuan is a Director at 3SPOKE and is focused on the firm’s investment and capital-raising activities.

PRIOR

Prior to 3SPOKE, Chris was a Vice President at StepStone Group, a leading private equity asset manager and advisor with USD 176 Billion of AUM. Chris was a key member of the private equity investment team with a focus on secondary transactions. Chris was responsible for leading the sourcing, underwriting, structuring, and execution of secondary transactions. His expertise extends across all types of LP-led and GP-led transactions including fund restructurings, spinouts, strip sales, continuation vehicles, directs, and structured solutions. Chris led over 30 closed secondary transactions, deploying over USD 1 Billion of invested capital. Chris was also responsible for numerous partnership investments and co-investments in the venture capital and growth equity space.

Prior to StepStone, Chris served as an Associate at MKM Partners, an institutional equity research and trading platform, where he conducted fundamental analysis and published research reports on technology & semiconductor companies. Chris’ tenure at MKM Partners helped him develop a keen eye for technology investment opportunities.

Earlier in his career, Chris was an Analyst at Burlingame Asset Management, an equity long/short hedge fund. During his time there, Chris sourced and conducted research on a broad spectrum of global investment ideas. His work included deep fundamental analysis and constructing complex investment models.

INTERESTS

Chris enjoys leading an active lifestyle with a focus on personal health and fitness. Chris lives in San Diego, California with his wife.

EDUCATION

Chartered Financial Analyst (CFA), CFA Institute

BA, University of California, Berkeley

BRAD GENDELL

PRINCIPAL ADVISOR

Experienced investment professional with over 25 years of experience raising and investing capital across private equity, venture capital, public portfolio management, and investment banking. Hands-on experience investing over $1 billion in private transactions and advising on over $3 billion of M&A and $400 million in IPOs in the U.S. and Asia.

CURRENT

Brad is currently a Principal Advisor to 3SPOKE while the Chief Financial Officer of PreciseDx.

PRIOR

Most recently Brad was a Managing Director of 3SPOKE and was involved in the firm’s deal sourcing, underwriting, and capital raising activities.

Prior to 3SPOKE Brad was the Founder and Managing Principal of Acclivity Capital Management, an equity long/short hedge fund manager with a special focus on analyzing the trading behavior of corporate managers and directors. He grew the business from scratch to about $80MM in assets under management. Prior to that, Brad was a partner and portfolio manager at Cumberland Associates, a fund manager with over $2 billion of assets under management.

Brad spent over a decade in the venture capital and private equity business, including as a Vice President at Warburg Pincus where he focused primarily on investments in the energy and financial services sectors, across all stages of a business’s development. Some notable investments include TradeCard (acquired by Infor), Flatiron Credit (acquired by Wells Fargo), and Competitive Power Ventures (one of the nation’s leading power plant developers).

Brad began his career as an investment banker at Morgan Stanley and Smith Barney, working over several years in New York, Los Angeles, Tokyo and Hong Kong.

INTERESTS

Brad enjoys hiking and running, playing bridge, and is an avid reader. He supports and volunteers across a range of community groups including serving as the past Chairman of JazzReach, a non-profit supporting music education. Brad lives in Los Angeles.

EDUCATION

M.B.A., Harvard Business School

B.A., Williams College

STEVE GOLD

CO-FOUNDER & MANAGING PARTNER

Experienced investment professional with over 25 years of experience advising entrepreneurs and investing in technology-enabled companies. A seasoned venture fund manager and secondary venture investor, with the last 10 years focused on pioneering and innovating the structured financing market for stakeholders of venture capital-sponsored assets, utilizing private shares or partnership interests as collateral.

CURRENT

Steve is the Co-Founder and Managing Partner of 3SPOKE and is responsible for all aspects of the management and strategic direction of 3SPOKE. As an early pioneer of structured venture lending, Steve created a new way to provide liquidity to stakeholders of leading venture backed private companies (including individual executives & shareholders, General Partners, and Limited Partners) prior to an IPO or sale.

Steve directs the firm’s investment process and chairs the 3SPOKE Investment Committee.

PRIOR

Steve was a Founding Partner of VSL Partners; Co-manager VSL Partners, LP and VSL Partners II, LP. As a Co-founder, Steve conceptualized the firm’s investment strategy and was instrumental in the development of the firm’s unique transaction structure. Steve led deal sourcing and execution for a significant percentage of the firm’s portfolio investments and co-investments across the firm’s two investment funds and was a member of the VSL Investment Committee.

Managing Director, Citi Private Bank: Steve joined Citi following the spin-off of Smith Barney to a JV with Morgan Stanley to aid in the strategic development of a global, fee-only investment advisory offering for clients of the Private Bank.

Director, Harris myCFO Investment Advisory Services: Steve led the investment team in the U.S. Western Region for a national multi-family investment office. Steve directly managed many of the firm’s largest and most sophisticated family relationships, representing over $4.5 Billion in assets directly under advisement, with combined overall net worth exceeding $40 Billion. Steve was a member of the firm’s Asset Allocation, Alternative Investment and Executive Committee’s.

INTERESTS

Steve is a gourmet home chef and a sports enthusiast, with a particular interest in golf, tennis, cycling and skiing. Steve lives in Boulder, Colorado with his wife and two young daughters.

EDUCATION

Chartered Financial Analyst (CFA), CFA Institute

BBA, International Finance, The George Washington University

IAN LEISEGANG

CO-FOUNDER & MANAGING PARTNER

Experienced private secondary market asset manager, technology entrepreneur, structured and derivative investments asset manager, financial assets, and financial markets professional with formal Chartered Accountant and Chartered Financial Analyst qualifications, combined with 25+ years experience.

CURRENT

Ian is the Co-Founder and Managing Partner of 3SPOKE and is responsible for all aspects of the management and strategic direction. Ian co-directs the firm’s investment process, leads the firm’s investor relationships, finance & operations and co-directs the 3SPOKE Investment Committee.

PRIOR

Ian has significant global public and private markets investment, trading and operating experience. Ian commenced his international investment banking and financial markets career on the derivative trading desks of the leading global financial firms in London, England. Followed by Ian co-leading the retail derivatives business and co-covering the institutional equity derivative client base for Deutsche Bank, South Africa. Prior to co-founding 3SPOKE, Ian co-led JPMorgan’s TMT industry coverage group out of the private bank, where he provided investment advice to the wealthiest private clients and family offices.

INTERESTS

Ian is a sport enthusiast, playing competitive golf with additional interests in yacht racing and mountain biking. Ian believes in actively supporting his community and has historically chaired the board of Orange County, United Way and been an active board member of UCI’s Applied Innovation Center. Ian lives in Orange County, California with his wife of 20+ years and their three children.

EDUCATION

CFA, CFA Institute

CA(SA), South African Institute of Chartered Accountants

B.Com (Honors), University of South Africa

B.Com (Accounting), University of the Witwatersrand

MATTHEW HARMAN

PRINCIPAL

Experienced investment professional with over 25 years of investing experience managing portfolios across public and private equity and credit securities in hedge fund, PE, and venture strategies. Deployed nearly $1 Billion in investment capital across primary & secondary direct, derivative, and structured investments in technology-driven growth assets since 2018.

CURRENT

Matthew is a Principal of 3SPOKE and is a member of the firm’s senior leadership and investment teams. Matthew is involved with sourcing, structuring, and underwriting portfolio investments as well as capital-raising activities.

Matthew is a member of the 3SPOKE Investment Committee.

PRIOR

Before joining 3SPOKE, Matthew was a Principal at Conversant Capital, and Head of Conversant Secondary Partners, focused on exploiting a structured secondary opportunity providing liquidity to holders of private REITs.

As a Senior Managing Director, Co-Head of Venture investing, and Head of Trading at Serengeti Asset Management from 2012 through 2022, Matthew co-created and ran the firm’s core private investment strategy focused on structured liquidity solutions for shareholders and option holders of mid and late-stage private growth companies. This strategy became one of the largest of its kind with over $700 million invested creating a portfolio of exposure to nearly 130 different private growth unicorn companies over a period of four years. While at Serengeti Matthew was a board member of privately held portfolio company, AMC, a direct advertising arbitrage business.

Prior to Serengeti, Matthew was Head of Trading and Portfolio Manager for the global distressed debt and special situation equity Hedge Fund team at MatlinPatterson, an $8 Billion+ AUM distressed debt-focused investment manager.

INTERESTS

Matthew’s passion is investing and is an avid reader of historical biographies and an active basketball and tennis player. Matthew lives in Livingston, New Jersey with his wife of 20 years and their three daughters.

EDUCATION

B.A., History, Literature, Economics, Duke University

Former board member of the Freeman Center for Jewish Life at Duke University

CRAIG WHITE

MANAGING DIRECTOR

Experienced investment professional with 20+ years of alternative investment proficiency across private equity and private credit opportunities working with global institutional investors, deploying over $3BN in committed capital mandates through direct, co-investments and partnership investments.

CURRENT

Craig is primarily responsible for building out and managing the 3SPOKE institutional investor base and will be a member of the 3SPOKE Investment Committee.

PRIOR

Partner and Head of Alternative Credit, Stafford Capital Partners: A senior alternative investment professional managing private credit allocations at a $5B asset management firm. Craig conceptualized, organized and led a new product vertical focused on global alternative credit strategies and launched with a $300 million commitment from an Australian Superannuation fund. Craig chaired the investment committee.

Employees Retirement System of Texas: Portfolio Manager, Private Equity. Deployed over $1 billion across commitments, direct and co investments across a global portfolio of buyouts, distressed debt, growth equity and secondaries for a $30 Billion defined benefit public pension plan.

Drum Capital Management: Managing Director. Spun out a special situations and private credit fund from Pacific Corporate Group and grew the assets to over $900 million in committed capital.

Earlier in his career, Craig was Vice President and Investment Consultant of the Private Markets Group with Callan Associates.

INTERESTS

Craig is an outdoor enthusiast, with a particular interest in trail running and camping in the North Georgia Mountains. He lives in Atlanta with his wife and three children.

EDUCATION

B.A., Business & Managerial Economics, California State University

Master of Science, Finance, Golden Gate University

CHRIS HSUAN

DIRECTOR

Experienced investment professional with over 14 years of experience, with the last nine years focused on investing in private equity secondary transactions. Experience leading complex transactions across GP and LP-led secondary opportunities, with significant experience deploying capital through directs, partnership investments, and co-investments.

CURRENT

Chris Hsuan is a Director at 3SPOKE and is focused on the firm’s investment and capital-raising activities.

PRIOR

Prior to 3SPOKE, Chris was a Vice President at StepStone Group, a leading private equity asset manager and advisor with USD 176 Billion of AUM. Chris was a key member of the private equity investment team with a focus on secondary transactions. Chris was responsible for leading the sourcing, underwriting, structuring, and execution of secondary transactions. His expertise extends across all types of LP-led and GP-led transactions including fund restructurings, spinouts, strip sales, continuation vehicles, directs, and structured solutions. Chris led over 30 closed secondary transactions, deploying over USD 1 Billion of invested capital. Chris was also responsible for numerous partnership investments and co-investments in the venture capital and growth equity space.

Prior to StepStone, Chris served as an Associate at MKM Partners, an institutional equity research and trading platform, where he conducted fundamental analysis and published research reports on technology & semiconductor companies. Chris’ tenure at MKM Partners helped him develop a keen eye for technology investment opportunities.

Earlier in his career, Chris was an Analyst at Burlingame Asset Management, an equity long/short hedge fund. During his time there, Chris sourced and conducted research on a broad spectrum of global investment ideas. His work included deep fundamental analysis and constructing complex investment models.

INTERESTS

Chris enjoys leading an active lifestyle with a focus on personal health and fitness. Chris lives in San Diego, California with his wife.

EDUCATION

Chartered Financial Analyst (CFA), CFA Institute

BA, University of California, Berkeley

BRAD GENDELL

PRINCIPAL ADVISOR

Experienced investment professional with over 25 years of experience raising and investing capital across private equity, venture capital, public portfolio management, and investment banking. Hands-on experience investing over $1 billion in private transactions and advising on over $3 billion of M&A and $400 million in IPOs in the U.S. and Asia.

CURRENT

Brad is currently a Principal Advisor to 3SPOKE while the Chief Financial Officer of PreciseDx.

PRIOR

Most recently Brad was a Managing Director of 3SPOKE and was involved in the firm’s deal sourcing, underwriting, and capital raising activities.

Prior to 3SPOKE Brad was the Founder and Managing Principal of Acclivity Capital Management, an equity long/short hedge fund manager with a special focus on analyzing the trading behavior of corporate managers and directors. He grew the business from scratch to about $80MM in assets under management. Prior to that, Brad was a partner and portfolio manager at Cumberland Associates, a fund manager with over $2 billion of assets under management.

Brad spent over a decade in the venture capital and private equity business, including as a Vice President at Warburg Pincus where he focused primarily on investments in the energy and financial services sectors, across all stages of a business’s development. Some notable investments include TradeCard (acquired by Infor), Flatiron Credit (acquired by Wells Fargo), and Competitive Power Ventures (one of the nation’s leading power plant developers).

Brad began his career as an investment banker at Morgan Stanley and Smith Barney, working over several years in New York, Los Angeles, Tokyo and Hong Kong.

INTERESTS

Brad enjoys hiking and running, playing bridge, and is an avid reader. He supports and volunteers across a range of community groups including serving as the past Chairman of JazzReach, a non-profit supporting music education. Brad lives in Los Angeles.

EDUCATION

M.B.A., Harvard Business School

B.A., Williams College

[ SOLUTIONS ]

Flexible Capital for Shareholders, Venture Funds and Investors

3SPOKE’s solutions are designed to maximize value and minimize risk and disruption to all stakeholders, with 3SPOKE’s capital utilized by company management, current or former employees and investors:

- to enable the exercise of vested employee stock options,

- for liquidity in lieu of a secondary market sale of individual company shares or portfolios interests,

- to enable fund managers to hold desirable assets longer

- for liquidity in advance of receiving general partner profit participation (Carried Interest)

LP SOLUTIONS

LP SOLUTIONS

Alternative to a Direct Secondary Sale

Flexible capital for liquidity in lieu of a sale without locking in a discount or forfeiting future upside participation

GP SOLUTIONS

GP Led Liquidity

Fund-Level Liquidity

Flexible capital for new or add-on investments, or accelerated distributions, without locking in a discount, while maintaining upside participation

GP Carry Advance

Carry Advance

Tax efficient and flexible capital solution backed by General Partner interest in single asset or multi-asset portfolio

SHAREHOLDER SOLUTIONS

Liquidity

Alternative to Direct Secondary Sale

More tax-efficient form of capital while offering more participation in future gains

Option Exercise

Employees Need Capital to Exercise Options

Potential for significant tax savings while protecting valuable options from expiring

[ SOLUTIONS ]

Emergence of Structured Liquidity Solutions

The private assets secondary market has become an important tool for private market stakeholders to manage their assets and provide liquidity to a formerly illiquid asset class.

While growth has been significant, the secondary market still represents an extremely small percentage of the overall private assets market value, leaving much room for continued growth.

This growth has led to the emergence of more sophisticated and customized solutions to address the liquidity needs of both private market investors and asset owners, including structured secondaries. These innovative solutions are one of the fastest growing segments in the private markets, with 3SPOKE an experienced partner providing liquidity to late-stage venture asset owners on behalf of investors interested in participating in this growth.

Find Out What 3SPOKE Can Do for You

[ SOLUTIONS ]

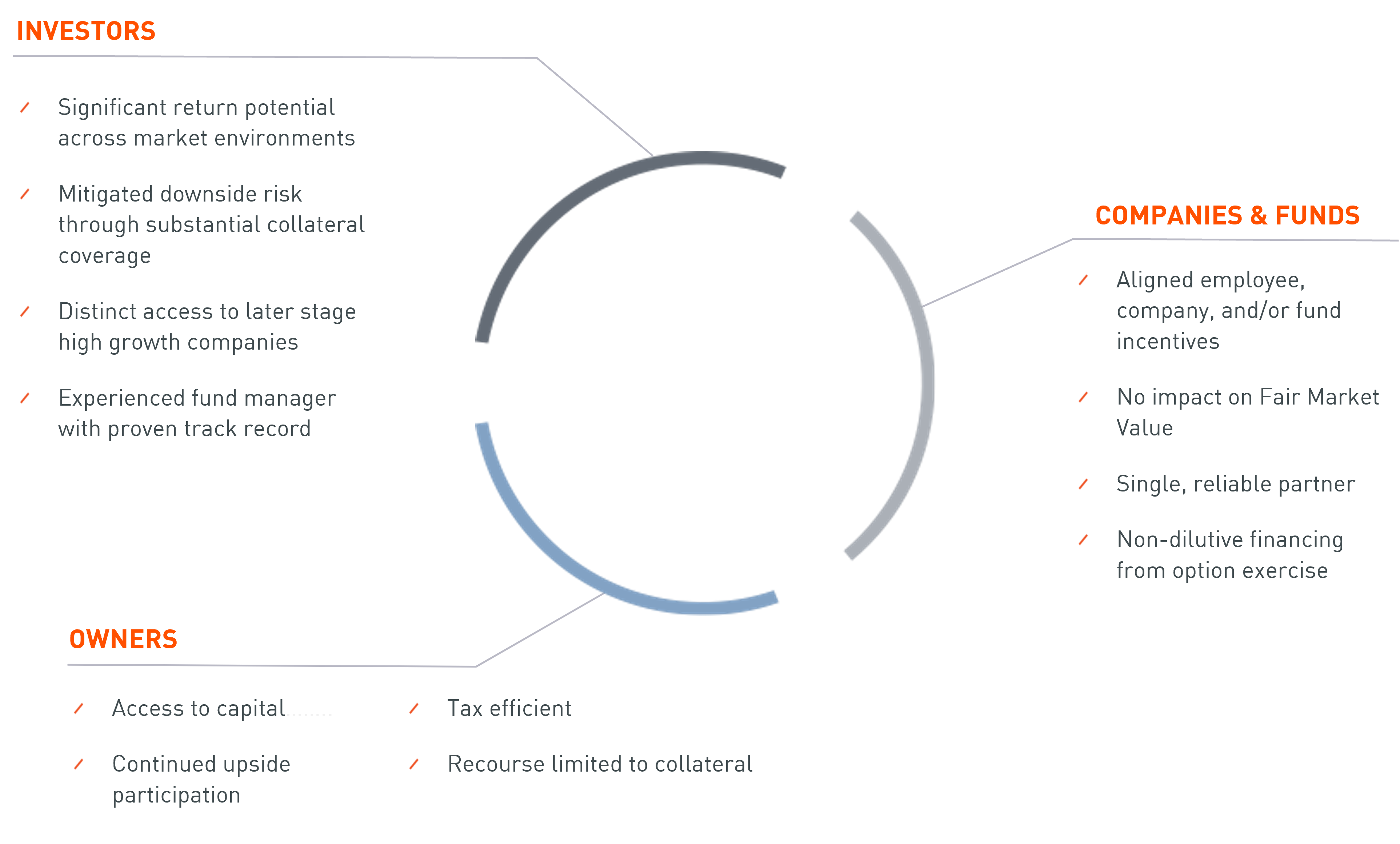

Value Proposition to the Ecosystem

3SPOKE offers balanced liquidity solutions to the venture ecosystem offering a more favorable form of capital to direct secondary market sales, while maintaining the alignment of interests of all parties.

[ TESTIMONIALS ]

Creative | Flexible | Collaborative

[ FREQUENTLY ASKED QUESTIONS ]

Understanding Structured Liquidity Solutions

Flexible capital. A trusted partner.

Learn more about how utilizing 3SPOKE’s structured liquidity solutions may benefit you.

Borrowing to exercise private company stock options

It is possible to use options and related stock for financing the purchase price and taxes related to a private company stock options exercise.

Yes! In many circumstances you can utilize your private company shares that you receive from exercising your options as the collateral for financing both the purchase price and any related taxes that are due on exercise.

There are several potential benefits to exercising your private company stock options and purchasing your shares today versus waiting, these include:

- Minimizing your tax obligations related to the option exercise and future sale of shares, resulting in the potential for more wealth earned from your shares.

- Presuming the share value increases over time, by purchasing your shares today, the difference (or spread), between the tax cost basis of your options and the fair market value at the date of your purchase, is taxed as compensation income and will be lower combined with any future appreciation being considered a capital gain. This allows you to lock in a lower purchase price and minimize your current tax obligations.

- Additionally, you will achieve more favorable tax treatment on any future gains in the value of your shares (assuming the shares are held for at least a year and therefore being subject to the lower capital gains tax rates), and

- Avoiding your options expiring with no value, which occurs 90 days or less following termination of employment or 10 years from the date of issuance (whichever comes first).

The taxes due on exercising private company stock options are calculated using the short-term capital gains rate (same as income tax rate) and are based on the difference (or spread) between:

- The cost basis of your options, which is normally the strike price of your options that is most commonly set at the company’s fair market value (409A value) at the time your options were issued, and

- The fair market value of your options on the date you exercise them.

From the date you exercise your private company stock options to the date you sell the related shares; any gains are subject to long-term capital gains tax rates (assuming at least a 1-year holding period).

Depending on the type of options you hold and the state you live in, the tax savings on any appreciation in the value of your options and/or related shares at long-term capital gains treatment versus short-term can be significant. The better your company performs, the larger the potential appreciation in value of your options/shares and thus the value of the tax savings. If your options are not exercised until your company experiences a liquidity event, the entire appreciation in value is taxed at the higher short-term tax rates. These higher taxes can be significant and affect the after-tax value you receive.

3SPOKE’s non-recourse financing can be utilized to exercise your private company stock options and purchase the shares now. This establishes both a lower cost basis and your holding period for favorable tax treatment in the future.

Depending on the amount and value of your holdings, this can potentially realize hundreds of thousands, if not millions, of dollars in more value from your stock-based compensation.

If your options expire, they become worthless.

Expiration of employee stock options typically occurs at the first to occur of:

- 90 days or less following the end of your employment with the company, or

- after 10 years from the original grant date.

If you have worked as an employee at a company for years with the prospect of a financial windfall, this can be devastating. To prevent this from occurring you need to exercise your options, which means you must purchase the shares at the price they have been granted to you and pay the tax costs of the exercise, the combination of which can be substantial.

3SPOKE’s non-recourse financing can be instrumental in assisting option holders with these costs and thus ensuring the options do not expire.

Borrowing against private company stock

It is possible to use your stock to finance personal expenses e.g. Diversification, Buying a house etc.

Yes! In many circumstances you can utilize your private company shares as the collateral for cash liquidity that can be used to fund personal expenses, e.g. Investment Portfolio Diversification, Buying a house, College tuition etc.

Two things happen when you sell shares today:

You will pay taxes on the difference (or spread) between:

- the cost basis of your shares (effective purchase price), and

- the sales price

Depending on how long you have owned the shares prior to selling, the spread will be taxed at either long or short-term capital gain tax rates. If you have held the shares for less than one year, the short-term rate applies, which is equivalent to your income tax rate.

If you need a certain amount of cash today, you will have to sell shares worth your required amount plus any additional shares to account for the tax costs associated with the sale. This can mean selling shares equal to 30-50% more in value than your cash need.

As an alternative, 3SPOKE financing is not considered a constructive sale, and thus no tax obligations are incurred upon receipt of the financing.

When you sell shares today you forfeit any future appreciation that occurs in the shares you sell. If your company is performing well and growth is strong, this forfeited value can be significant. Having sold fewer shares when obtaining 3SPOKE financing, the better your shares perform over time, the better off you will be financially compared to selling your shares today.

There are several reasons why it might make sense for a shareholder to borrow funds today versus waiting for a future sale:

- Certainly, if you have a current cash need, borrowing is a great way to accomplish Buying a house, Funding college tuition, etc., without selling your shares.

- As venture-backed companies are staying private longer, the time a current shareholder has to wait until a liquidity event can be long and uncertain.

- Borrowing against the value of shares today can also be viewed as a partial hedge on the performance of the shares over this uncertain timeframe while providing the liquidity to achieve some investment portfolio diversification.

- If the company falters or is acquired for a value not favorable to common shareholders, receiving some liquidity now on a non-recourse basis would be beneficial.

Tax and Legal Advice Disclaimer

3SPOKE and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.